The cyber market should also grow to $20bn-$25bn from the high-single-digit billions it is today, as the industry mobilizes to address mounting risk, the Aon CEO said in an interview with this publication.

The executive also addressed questions on the termination of the Willis merger, and what Aon had learned from the reversal.

Case provided the directional figures on new markets in response to a challenge around what success would look like for the industry innovation agenda to create the "net-new" markets he has championed.

But he added: "Success, first and foremost, has to be defined through the lens of our clients."

Case stressed that, for the industry to generate real solutions "at a scale where they matter for clients", the premium pools needed to exceed $100bn in both IP and products geared towards helping clients go net zero.

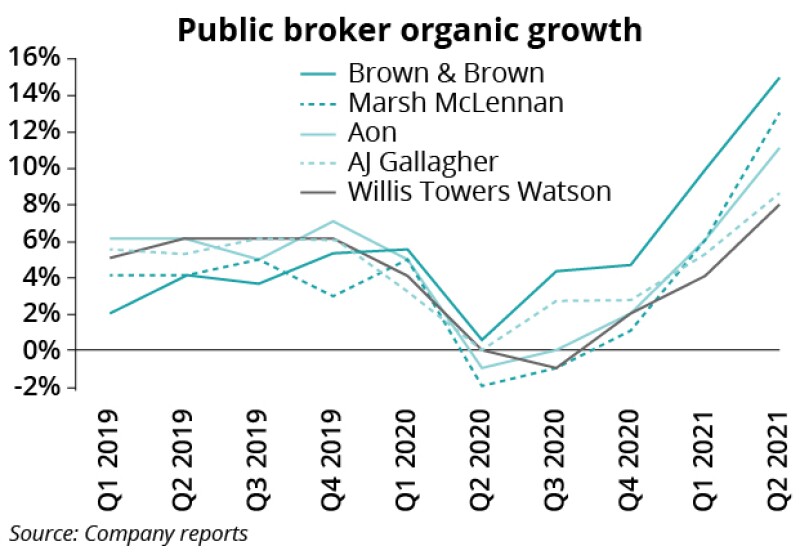

The public brokers have enjoyed their best quarter for growth in almost a decade, fueled by what this publication has called a brokerage "supercycle" resulting from rebounding economies, rising rates and an enhanced appreciation of risk from clients which could see a sustained period of outperformance.

Pressed on the applicability of the thesis and whether the firm was seeing higher demand resulting from an increased client view of risk, Case quipped "who cares" when it comes to brokers and markets. "This is about client need," the Aon CEO said, arguing that the other drivers of broker top line will ebb and flow in any case.

Case maintained that the key was to ensure that, in 10 years, the industry is more relevant to its clients on emerging risk and removing fresh sources of volatility than it is now.

"We are incredibly optimistic about what our industry can do on behalf of clients, but the current course and speed is not going to get us there," he said. "The question is, will we rise to the occasion?"

Case said this would require brokers and markets to innovate to deliver new products.

"Part of this is that we have to help clients understand why it’s important and valuable for them to pay for this volatility reduction," the Aon CEO argued.

The executive said increased appreciation of risk often comes via major loss events, with awareness of pandemics requiring the Covid-19 catastrophe.

Case argued that the industry had to find a way of communicating the degree of risk and need in other areas without the need for total climate breakdown or a massive systemic cyber event.

"[Instead] you use content, innovation, analytics in a way that helps them actually see possibilities they didn't see before."

Case explained that real success will depend upon the whole ecosystem coming together to address client need.

"This is about an entire industry coming together to do work on behalf of clients in a way that we, frankly, haven't done before," he said.

Lessons learned

Case was speaking after Aon's proposed mega merger with Willis Towers Watson was terminated in the teeth of Department of Justice opposition, following 16 months of integration work.

The dismantling of the deal cost Aon the $1bn break fee and $350mn-$400mn more in transaction-related costs and denied it the opportunity to execute on the most ambitious piece of M&A in the sector's history.

However, Case insisted Aon "has emerged stronger as a result of the last 16 months", and he stressed that the firm had been reconfirmed in its strategy "Aon United", with stronger convictions.

This strategy combines the imperative to innovate to address unmet client need and to connect the dots between the different parts of Aon to present a broader array of capabilities to clients.

"What’s come through loud and clear is the opportunity to accelerate that strategy," he said. "With the combination, without the combination, it's incredibly compelling."

Case said the Willis merger had offered the opportunity to accelerate Aon United. "Absent that, [there are] multiple other ways we're going to accelerate it. We're marching on."

He also stressed that walking away from the Willis deal offered greater certainty around the future, particularly for Aon staff.

"It's also created in our colleagues an excitement around the future without integration – because there's no uncertainty here, there's just clarity on what we're going to do."

As the company tries to reframe the narrative following the dissolution of the merger, Case emphasized Aon staff buy-in resulting from the reconfirmation of its strategy and the elimination of uncertainty that comes from putting two businesses together.

He told this publication Aon had recently registered its highest ever engagement level – around 80% – in a pulse survey of staff. And he rejected the idea staff turnover was elevated, revealing that "voluntary turnover is at an all-time low".

Asked what he had learned from the attempted deal, Case said the integration work had been a valuable learning experience that would now be turned to account in other ways.

The executive said what the firm had learned about its operating model – and "how to digitize" the firm – had been "huge".

"We've got more tactics, more understanding, more specifics around how we strengthen that operating platform.”

Case said Aon was now pursuing these enhancements to its operating platform Aon Business Services with full force and at greater speed due to the absence of the integration exercise.

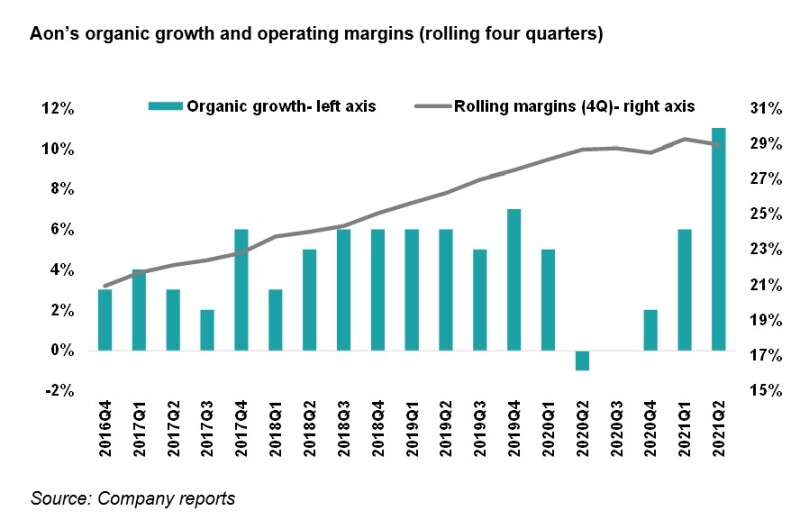

The share services unit has been a key driver of the upward march of Aon's margins over the past five years, and his words may elevate expectations that the firm can continue this.