It is unlikely many of you were lucky enough to dodge that time period. In case you missed it, the evolving narrative was along these lines:

“This is an isolated crisis impacting a small part of the financial system; there is no liquidity crisis.”

“There is a banking sector liquidity crisis, but insurers are fine since they hold assets to maturity.”

“Oh wait, these marks are too much and we are headed to a recession”

…Recession!

This past week/weekend has seen continuing reverberations that began with the collapse of SVB. On Sunday, UBS announced that it was acquiring (saving) Credit Suisse on attractive financial terms, with downside protection. The financial markets continue to react to uncertainty and as the chart below shows, it’s been rocky year so far.

Taking a step back, the bigger question lies in the interplay between banking issues and whether there’s a potential for contagion among insurers.

Firstly, banks and insurance companies have a different exposure to risk from the macroeconomic environment. Unlike banks that face time deposit pressure, insurance companies tend to have longer-term relationships with customers, who don’t constantly look to shop their coverage. Additionally, insurers pay close attention to investment durations and their asset/liabilities portfolios.

Secondly, recent bank take-outs and mergers might spur insurance companies to revisit their plans. With capital becoming scarcer, and diligence likely picking up, the situation might result in consolidation beyond the banking sector.

Thirdly, for the broader insurance industry, capital remains stable, and a shift in economic conditions will not immediately undo the effects of the good run they have had.

We discuss these points in detail below.

First, insurers don’t have a threat equivalent to the “bank-run” scenario

While some of the recent events are reminiscent of the mortgage crisis, the present situation does not mean we are going to see a repeat of that scenario. The risks banks and insurers face from the economy, and interest rates, in particular, are very different.

There are three possible “black swan” scenarios for insurers.

a) Customers migrate to other insurers: Mid-policy period carrier changes would result in a return of unearned premiums. If this occurred on a large scale, it could lead to widespread sell-down of assets. However, this is unheard of.

b) Outsized losses result in large payouts: Larger-than-anticipated catastrophe or non-catastrophe losses could result in asset-liability mismatch and force insurers to sell assets at a loss.

c) Adverse reserve events: Unforeseen adverse development in accident years leads to revisiting investment durations.

All three of the above events have a low likelihood of presenting themselves, and this makes the insurance industry more secure than the banking world, where the threats are much more present on a daily basis.

As discussed in our past note, many banks have faced a shift in their deposits, as depositors relocated their funds to pursue the recent interest rate increases. This leaves them open to duration risk (the risk that the asset value will go down as interest rates rise), especially if they are invested in longer-term instruments.

On the insurance side, the risk from duration comes from matching assets to liabilities. As the chart below shows, many companies (representative sample shown) had in fact reduced duration in anticipation of increasing rates.

We chose to show 2018 as the point of comparison as interest rates were also on the rise at that time. The chart shows that most carriers have lower durations now than they did back then. So, in 2022 they were diligent in limiting their interest rate risk ahead of the sharp rise.

The other issue that plagued the banks was the value of unrealized mark-to-market (MTM) impacts on their balance sheets in their held-to-maturity (HTM) portfolios. In our prior note we showed the impact of this on various bank balance sheets.

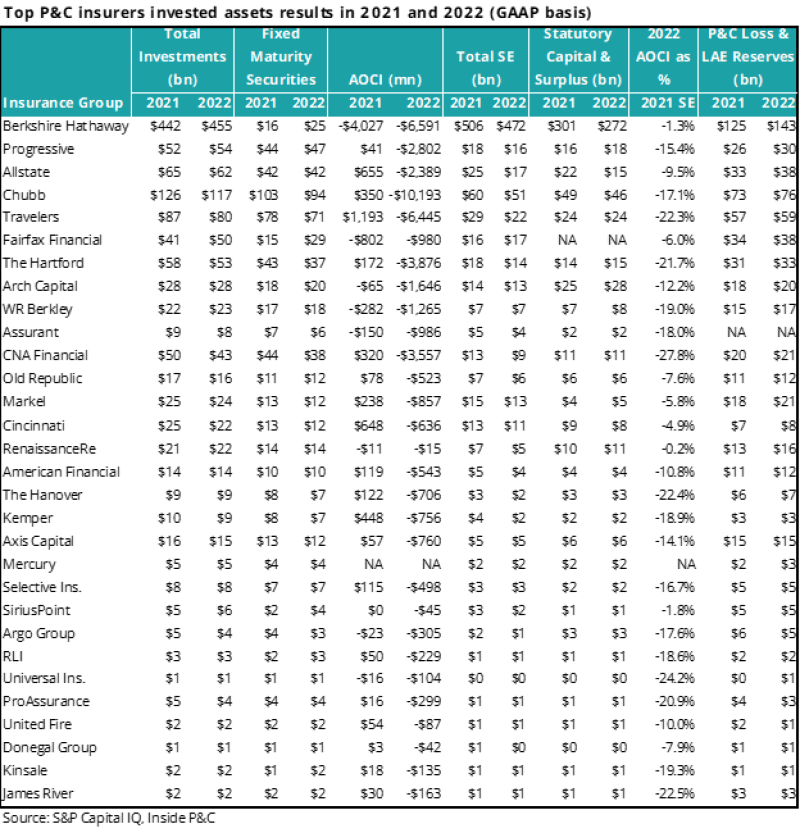

On the insurance side, portfolios are often concentrated in the available-for-sale (AFS) bucket, so are marked down based on interest rate shifts via accumulated other comprehensive income (AOCI). The table below shows AOCI and several other metrics.

Note the decline in shareholder equity from 2021 to 2022. Over time these marks will reverse, but for capital-deficient players, it could lead to what we discuss in the next point.

Beyond the investment portfolio, loss reserves have remained stable, as shown in the last two columns above, and social inflation hasn’t impacted the results in the way anticipated.

Second, although M&A deal volume is low during a hard market, continuation of present conditions could lead to a pick-up in consolidation activity

The chart below shows insurance deals since 2005, with CIAB commercial pricing data overlaid. Typically, deal activity takes a back seat during a traditional hard market, as can be seen in the somewhat inverse correlation below, with the number of deals declining as pricing rises.

The current consolidation in the bank space is analogous to members of the group throwing lifelines to each other to keep the group afloat, so that a few sinking firms don’t drag the entire sector down.

Clearly, the financial system will look quite different on the other side of this turbulence. With increased cost of capital, and with lenders exercising enhanced due diligence, it’s likely that sub-sectors such as InsurTechs, smaller Florida players, and intermediaries will be more open to consolidation options.

Lastly, insurance industry capital remains stable, but insurers should monitor the macro landscape

The chart below shows year-over-year GDP growth against the industry net written premium growth and combined ratio for the past 30 years.

Taking a step back, one can see that macro issues do impact the top line, as might be expected, with economic growth growing exposures and demand for insurance. Despite this correlation, several periods lie outside the trend, due to their unique conditions.

Prior cycles were more defined by industry capital, and right now we are experiencing a mix of “micro cycles” by line of business. So even if the macro plunges, it is not necessarily the case that this will extend to insurance.

Keeping that in the background, insurers should consider the following three sub-points as we head into the crucial Fed decision tomorrow.

a) Interest rates: If the Fed stays the course and raises interest rates tomorrow, insurers may see continued higher reinvestment rate for investments, pressure on AOCI from past instruments, and likely pressure on loss cost inflation vs. earned rates.

b) The macro picture: With the fluidity of all of these situations, it’s unclear what the recessionary outlook might be. In the worst-case scenario, we could see businesses entering conservation mode and reducing their insurance purchasing as exposure growth slows.

c) Bank failures: Insurers’ daily operations could be impacted by bank failures, but only to the extent they are using that bank. Also, if insurers hold stock or bonds of these banks, investment income might be impaired. This will likely dominate conversations as we head into first quarter reporting.

In summary, on a near-term basis, it is unlikely that the bank contagion will spread to the insurance sector as we saw in 2008. However, its impact will be felt via investment strategies, capital allocation, insurance consolidation and the longer term macro outlook for the country and the economy.