This is the latest in a slew of disruptive events we have seen this quarter, giving an extremely rocky start to the financial year and clouding a future already made unclear by the longer-term macroeconomic forces of interest and inflation.

If you’re a bank or a bank investor, these bank failures are beginning to feel like Groundhog Day. In 2008, it was only a matter of time until the contagion spread from one part to another like Covid -19 jumping borders.

In 2023, things appear to be different, at least on the surface. The jury is still out on an impending recession, a soft landing, or whatever words you want to use to convey the present scenario. Tomorrow, the Fed is again expected to raise rates by a quarter point which should mark the end of the present rate increase cycle.

Insurance is somewhat less correlated to the overall economy than the price of a dozen Grade-A eggs. That said, the resilience we have seen in pricing and its translatory effect on insurance brokers has been nothing less than surprising. Until now…

This quarter’s broker results show a greater degree of unevenness, compared with the “rising tide lifts all ships” story we’ve seen for the past few years. The chart below shows how the 12-month stock price change compares to YTD for each company, and we can see significant shifts. Some of this change was driven by post-earnings increases/declines as the brokers revealed unexpected impacts, or adjusted guidance.

One thing is clear: the brokerage super-cycle is getting close to its final leg, if not already at an end. As our note below will show, this quarter’s organic growth range was wider. Yes, commercial pricing is in a reacceleration mode, and reinsurance pricing remains strong.

That said, top-line growth at commercial insurers was also uneven, reflecting growth fatigue. Our note will also show the margins remain strong, although the growth slope is getting less steep. We’ll also look at some of the comments on growth via consolidation, where it’s clear that a demand/supply gap for higher rated partners exists. Does this impact the growth trajectory? It’s unclear.

First, organic growth was strong, but the mix of drivers make the underlying trajectory unclear

This has probably been one of the least predictable quarters in recent memory for both brokers and carriers. The outlook was already murky due to macroeconomic factors, but then we also had the hardening of the property catastrophe market, which we knew would affect brokers unevenly based on business mix. This, combined with the continuing surprises from pricing in the commercial sector, meant that the quarter could be yet another surprise.

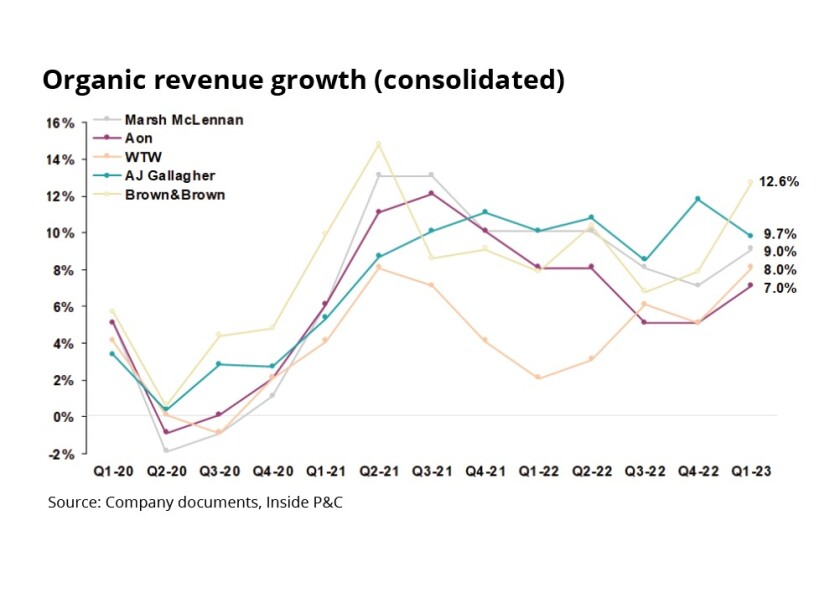

The result was a general positive trend on organic growth as seen below, though results are stratified over quite a range. The outlier is AJ Gallagher, which went down to 9.7%, but that still puts it second highest in the cohort.

We should note that this is not an apples-with-apples comparison, and differing business mixes mean the companies are facing different forces. It is also somewhat subject to the brokers’ definitions, as organic growth is a non-GAAP matric.

The primary driver for growth is, of course, pricing. Unfortunately, it takes a little while for survey results to come out, so our latest data point is Q4 2022. However, call commentary indicated rates are not slowing in core lines, though workers’ comp is pretty flat and financial lines continues to soften moderately.

We did note that, while most commentary suggested rate growth, WTW said growth had slowed. To investigate this further, we have plotted the CLIPS (actual proxy of rate filings) pricing data against the more general CIAB to see how they have differed in the past.

It is interesting to note that, over the past 20 years, CIAB has almost always stated rate changes as lower than CLIPS, so it may be meaningful that CLIPS is showing a downward trend while CIAB is not.

Our recent piece on Chubb noted significant pricing increases as well (as high as 16.9% for property), and with that level of growth we might have expected a slightly better showing on the broker organic growth front especially for Aon and Marsh.

However, we would note that there is a distinct possibility that the larger brokers don’t benefit to the same extent due to the weighting of fee business in the book (fee business is more common with very large clients and is a flat amount vs. a %). In other words, a 16% jump in pricing doesn’t raise their revenue by 16% because the fees are fixed, whereas a smaller broker like AJ Gallagher or Brown & Brown might see a more direct benefit if they have a more commission-based book.

Another differentiator on the pricing front is reinsurance, which grew significantly in Q1. We knew this going into the quarter-end and had previously reported Howden’s rate-on-line index grew over 30%. While this doesn’t translate directly into an equal commission/fee earnings growth for the brokers, we knew there would be some boost to numbers for the carriers that have a significant reinsurance book – namely Aon, Marsh, and AJ Gallagher.

Those brokers did see boosts to their individual books as shown in the reinsurance organic growth table below.

All in all, this has been a standout quarter for growth, but the Q1 boost from reinsurance is a one-off, or at best cyclical, and the rest of the growth will be dependent on the pricing trajectory going forward. When the trend turns down, we should remember it is more of a normalization than a worsening, as we head back to pre-super-cycle growth.

Second, for most of the group, margins continue their steady improvement, but we need to start talking about terminal numbers

With inflation playing such a major role in both head- and tailwinds for brokers, we can’t discuss growth without looking at margins. The same change that boosts exposure is growing expenses and wage inflation.

The chart below shows the cohort’s rolling adjusted operating margins (to account for cyclicality). As with organic growth, we would note again that this is not apples to apples, due to business mix and differences in definitions. Instead, we look at these directionally for each carrier.

With the exception of WTW, the cohort continues to improve. This is in part driven by the organic growth above. But it is interesting to note that the growth in top line doesn’t correlate to the growth here, so we can definitely see the effects of other factors.

Brown & Brown is essentially flat, whereas it had the largest increase in organic growth. Taking a step back, this makes sense, as there are expenses associated with growth so, to simplify a bit, it grew equally in expenses and revenue. Aon is interesting as it managed to tick up despite a change in T&E driven by decreases during the pandemic. WTW was very excited about its margin expansion on the call, but this was a quarterly number, and we can see here, is not indicative of the trend. We will wait for a few more quarters before we become optimists.

This growth was in the face of several material headwinds, some that we can expect to be ongoing and continue to hurt the bottom line, and others that are more sporadic. In particular, hot topics this quarter were FX headwinds, effective tax rates, increased expenses and wage inflation. On its call, Marsh did give guidance indicating margin expansion in Q2 will be less, due to talent investment and T&E. However, we would point out that Q1 is often a higher margin quarter, which is why we compare on a rolling basis.

The moving pieces this quarter did allow for continued growth. However, considering the large growth in top line and somewhat noisy expenses and headwinds, it is difficult to identify the underlying trend, and we would be cautious regarding an expectation of continued improvement.

Aon for example, has touted its consistent growth trend over the past 10 years. Its growth is indeed strong and consistent, but eventually that scale will no longer be possible from a mathematical perspective. Our view/hope for these brokers should be that they are able to find their optimal terminal margins and maintain those in the face of macroeconomic uncertainty.

Third, while M&A is still a key part of the strategy, the outlook is uncertain

The key pillars of broker capital deployment strategy are buy-backs, investment in hiring, and M&A. As we discussed in a recent piece, the carriers prioritize these somewhat differently depending on their view of longer-term results of such investments, but it is still a core activity across the cohort.

However, the wild shifts in interest rates over the past years has made this a quickly changing landscape, and brokers have had to balance their acquisition interests against the rate environment.

Speaking about the landscape, Marsh discussed the headwinds to its M&A strategy caused by a competitive market, but indicated that this was more in Q4, and less in Q1. Looking forward, the company expects a rebound over the next one or two quarters.

Pat Gallagher gave a similar view, with a bit more color. He said the prior market had become more competitive with year after year of new PE entrants, but as there have been fewer entrants, deals have slowed. However, even with this change, competition has not reduced enough to see a drop in multiples. If trends continue along this track, and depending on interest rates, he indicated he would expect to see the multiples come down in the future.

Whatever difficulties exist, brokers continued to close major deals in Q1, with Marsh closing on BT Super, AJ Gallagher acquiring Buck, and Aon acquiring Tyche, to name a few.

In his comments, Gallagher also said he was aware that some major players had gotten significant funding in the past 60 days and were “flush.” Adding to this, Marsh indicated an intent to deploy $4bn in capital (with the proportion of this dedicated to M&A to depend on the macro), and AJ Gallagher intending to spend $2bn on M&A (having already spent $600mn to buy Buck).

AJ Gallagher also disclosed a plan to spend $3bn in 2024 on M&A, so it is clear it has no intention of slowing.

Aon, Brown & Brown, and WTW gave fewer specific details, but indicated M&A was still central to their strategy, noted success in Q1 acquisitions, and touted strong pipelines.

The bigger uncertainty from here is a slowdown in organic growth opportunities if the insurance pricing cycle starts to decline, especially if this shift intersects with a recession. Further complicating the macro scenario is the impact of the debt ceiling resolution, additional bank failures, and the impending problems in the commercial real estate space. If all these factors do go south it could create additional uncertainty in the near term, and change insurance buying behavior.

In summary, we continue to see the strong growth of the past couple of years, but this quarter’s results have begun to show some unevenness, which has been reflected in stock prices. The growth has been propelled by pricing and inflation, both of which may slow in the coming quarters, making the future unclear. Factors like FX and wage inflation may continue to weigh on companies while the top line shrinks, thereby contracting margins. As these and other factors play out, we will be watching the M&A situation to see how it develops.