Another month of inflationary concerns increases the chance consumer behavior will react to the inflationary fears and put a dent in the pace of the recovery.

The CPI rose 5.4% YoY, reaching levels not seen since 2008, surpassing last month’s surprising 5% and the 12-month average of 2.3%.

This has been in large part driven by the increase in prices for used cars and trucks, as the chip shortage has limited the supply of new vehicles and repossessions decreased during the pandemic. The chart below shows the wholesale price of used cars has jumped 34% YoY, in a market that has historically been very stable.

The higher vehicle prices are not limited to the “total loss” scenario which would warrant a new replacement vehicle. The increase in costs has also been seen in car parts and rental car prices. Given the lack of vehicle supply, car rental costs have increased, which have been further exaggerated by the surge in demand for post-pandemic travel. This means insurers that have not pre-negotiated pricing with rental companies could be paying more.

To put short-term concerns in perspective, we saw similar pricing fears earlier this year when the lumber costs jumped. There was concern that homeowners’ insurers could be faced with higher claims, particularly in the event of a catastrophe event. But lumber has come sharply down from its extremely elevated May peak, although it remains well above its five-year trailing average.

After all, vehicle pricing is just one factor impacting the personal auto claims severity and the chip shortage is likely to ease by early 2022.

Until then, the recent reversion in loss cost trends in personal auto - driven by the economic recovery - is likely to continue. Personal auto carriers benefited from low-frequency trends during the pandemic, as miles driven plummeted. Recall, carriers issued discounts to drivers during the early months of the pandemic after experiencing better than anticipated trends.

June’s CPI data suggests the cost of insurance is in line with June 2019 (but up 11.3% YoY), after a historic low period lasting April 2020 to March 2021.

Prior to the pandemic, personal auto premiums were at their lowest levels since 2007, as firms were competing to increase their market share. This is illustrated below as average severity inflation outpaced premiums.

The recent premium spike is simply the reversion to 2019 pricing, leaving companies with the option of continuing their 2019 competitive path for growth and risking margin surprises, or building on the pricing momentum to take further rate.

All in, for June, our average severity estimate based on BLS data came out to 3.2%, compared to the previous month’s 2.8% estimate, suggesting claims severity is increasing slightly.

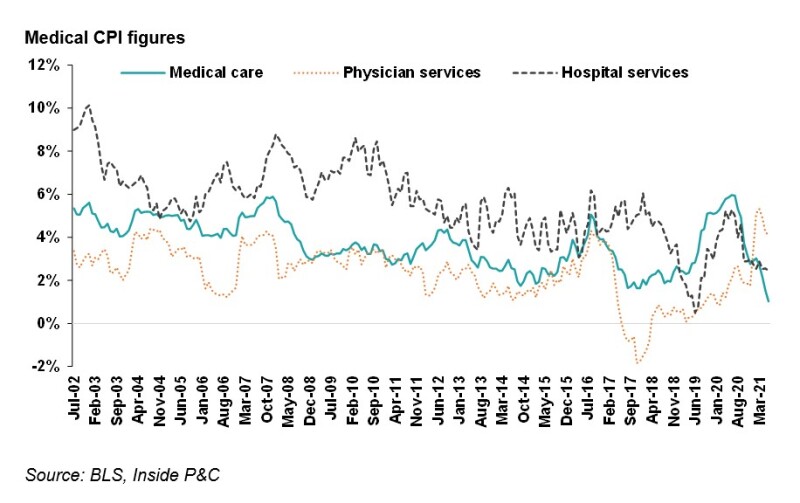

Severity was estimated using CPI trends for medical and vehicle costs. Medical CPI figures increased 2.5% in June (down from 2.8% in May).

Physician services inflation has been trending up since early 2018. This has in part been due to the consolidation in physician practices, which was exasperated by the financial pressure independent practices faced during the pandemic as patients put off appointments. On the other hand, medical care and hospital services have been trending down since mid-2020, after facing demand surge from Covid and associated supply chain issues.

Vehicle CPI figures averaged 3.9%, a jump from last month (2.9%). The result was led by body work and parts and equipment, 5.1% and 3.5%, respectively (vs. 3.7% and 2.1% in May).

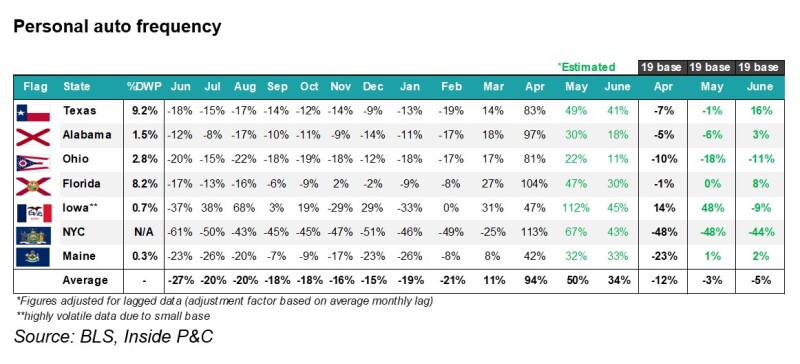

In terms of frequency, June’s accident data still shows some frequency benefits, as compared to 2019.

We estimate the frequency of auto claims by looking at the number of car accidents from a sample of state DOT databases. We estimate June’s frequency is 5% lower than pre-pandemic levels, although the trends differed significantly across states, with Florida and Texas seeing more accidents last month than in June 2019, but NYC still maintaining much of the pandemic benefits.

Even in the best-case scenario with no further frequency escalation, personal auto carriers will need to react to short-term inflationary movement or risk narrowing margins.

Progressive’s monthly earnings release last month showed the underlying loss ratio reverted to pre-pandemic levels, but the quarterly release later this week will provide additional details and substantiate whether loss cost trends have deteriorated further from 2019.

As Progressive’s CEO Susan Griffith put it in the last earnings call: “Will there be more highway travel because you're packing up the kids to go see grandma and grandpa? And will that cause less volatile accidents?…When people are starting to work from the office? And we're going to continue to watch that because we think that could creep up pretty quickly, and we want to be on top of that.”

It appears Progressive, among other personal auto insurers, is looking for possible changes in driver behavior that they haven’t had to previously assess. This adds to the complexity of estimating how frequency and severity will play out in the coming quarters.

With loss cost trends reverting to pre-pandemic levels and higher inflation likely to continue for the near future, personal auto insurers are finding themselves in defensive mode as they try to estimate impacts as we head into 2022.