TO READ THE FULL 14-PAGE PDF CLICK HERE.

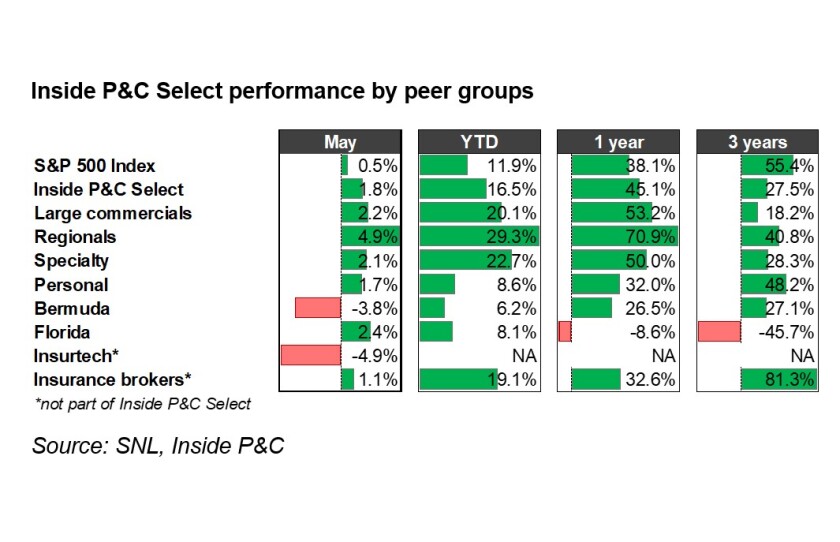

In May, the market-weighted performance of our select of P&C stocks – the Inside P&C Select – was up 1.8%, outpacing the S&P 500 at 0.5% but underperforming banks at +5.5% and life insurers at +4.9%.

With the market already bearing much of the benefit of the anticipated economic recovery earlier this year, May stocks performance were relatively muted. This movement followed April’s CPI data release with stocks rebounding only days later.

The speed of the economic recovery continues to be of focus, but the month of May yielded limited surprises, leaving stock performance incrementally higher and investors awaiting the 6/4 job report.

April’s disappointing job report left investors on edge that the economic growth trajectory may be slower than anticipated and another month of missed targets could add to the pessimism.

As our colleague Adam McNestrie discussed, the increase in consumer pricing growth from 2.6% in March to 4.2% in April took the market by surprise and increased fears of inflation, with further increases threatening the current bull market and undercutting the recovery.

Inflation expectations have crept up over the past few months, but May saw no substantive movement.

The mid- and long-term Treasury yields have also held steady since March.

Without as much macro news driving the volatility, May’s stock performance saw a greater sector specific focus, with investors forgoing the “Sell in May” guidance across the segments, with the exception of reinsurers.

There was little impact on stock performance from the forecasted above-average hurricane season.

Our analysis found that although insurance stocks tend to modestly underperform the S&P 500 during hurricane season (-0.5% vs. +1.2% the rest of the year), the correlation is not based on forecasted activity levels and relative stock performance can differ significantly from year to year.

Reinsurers were down 3.8% for the month of May given the disappointing 6/1 pricing commentary. Renaissance Re was down 8.7% in May, followed by Everest Re down 6.1% and Axis down 3.9%.

With abundant reinsurance capital in place, pricing commentary around 6/1 included moderate increases but did not reach reinsurers’ desired levels. This followed a “dampening” of price hikes at 4/1 renewals and a trailing 5-year period that was the most loss-heavy on record.

Large commercial insurers showed incremental growth, up 2.2% monthly, outperforming the Inside P&C Index and continuing to benefit from the positive pricing commentary, stabilizing economy, and anticipated infrastructure spending. Best-performing in the commercials was AIG, up 9.1% in May and 43% YTD.

On the other hand, as anticipated, The Hartford and Chubb were both slightly down for the month, after seeing the stock benefit from the acquisition offer last month.

As mentioned in our recent report, we aren’t sure how long the “hardening” rate commentary will last, given carriers focus on top line growth and the levels of rising industry surplus.

Personal lines carriers also outperformed in May (up 1.7% vs. S&P 500 up 0.5%), with Allstate leading at 7.7%. However, we don’t anticipate much further increases as the Covid- induced benefits on loss cost trends are running out and valuations for the group largely recovered earlier this quarter.

InsurTech names underperformed, driven by Root down 15% for the month, while Lemonade rebounded after seeing price declines mid-month following release of first quarter earnings. Root’s year-to-date sell-off (down 41.9%) continued and coincides with the broad risk-off sentiment we’ve seen in ultra-growth startup stocks and SPACs.

Lastly, insurance brokers were largely in line with most other P&C peer groups at 1.1% in May. Like we discussed in the Q1 brokers wrap, the year may present strong tailwinds for intermediaries. Their P&C brokerage operations continue to benefit from high rates and a rebound in exposure units. In addition, discretionary consulting revenues should also expand in the coming quarters on the back of higher discretionary business spending and an increase in covered lives.

Elsewhere, the Aon-Willis arb spread remained in the 4%-5% range as the parties seem close to finalizing the merger following the announcements of asset divestitures to AJ Gallagher, Aquiline and Alight.

TO READ THE FULL 14-PAGE PDF CLICK HERE.